Fact Check

Tobacco and alcohol are currently charged an excise tax and value-added-tax (VAT) by the government.

To check this claim, FactCheck.lk consulted the Central Bank of Sri Lanka’s Annual Report for 2021 to obtain the excise tax on cigarettes and alcohol (liquor) and the Ceylon Tobacco Company’s Annual Report to obtain the VAT paid on cigarettes.

VAT revenue collected on alcohol was available only until 2018 in the Inland Revenue Department’s Annual Report. Therefore, the revenue for 2021 was estimated based on the growth in the total sales value of the industry and after adjusting for a cut in the VAT rate from 15% to 8%.

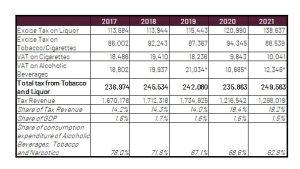

Accordingly, the tax revenue collected from excise taxes on cigarettes and liquor amounts to LKR 88.6 billion and LKR 138.6 billion, respectively, in 2021. The estimated VAT collected from cigarettes and liquor amount to LKR 22.4 billion in 2021, which increases the overall consumption tax on these products to LKR 249.6 billion

The total taxes collected by the government in 2021 was LKR 1,298 billion. As such the overall consumption taxes collected from tobacco and alcohol amounts to 19.2% of the total tax collected in 2021. This is in line with the MP’s claim.

Therefore, we classify the MP’s statement as TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

Exhibit 1: Government tax revenue (in LKR Millions)

Source: CBSL Annual Report, CTC Annual Report, IRD Annual Report

Additional note 1: The share of tax revenue collected from tobacco and alcohol has increased from 14.2% in 2017 to 19.2% in 2021. However, actual taxes on tobacco and alcohol increased only about 5.3%. The increase in share is due to total tax revenue of government decreasing by 22%. The data shows that the tax collected from tobacco and alcohol decreased relative to GDP and relative to consumption cost of tobacco and alcohol. According to the CBSL annual report, as a share of GDP, the tax collected from tobacco and alcohol decreased from 1.8% in 2017 to 1.5% in 2021. As a share of total private consumption expenditure on alcoholic beverages, tobacco and narcotics, the tax collected decreased from 78.0% in 2017 to 62.8% in 2021.

Additional note 2: Although, tobacco and alcohol companies also pay Income tax, it is not considered in this fact check as it is not directly charged on the sale of the product. In addition, the tobacco producers also pay a tobacco tax (LKR 15 million). However, it is insignificant for the purposes of this analysis.

Sources

Central Bank of Sri Lanka, Annual Report (2021), available at:

https://www.cbsl.gov.lk/en/publications/economic-and-financial-reports/annual-reports [last accessed: 30 September 2022]

Department of Inland Revenue, Annual Report (various years), available at: http://www.ird.gov.lk/en/publications/sitepages/Annual%20Performance%20Report.aspx?menuid=1501 [last accessed: 30 September 2022]

Ceylon Tobacco Company, Annual Report (Various years), available at: https://www.ceylontobaccocompany.com/group/sites/SRI_9PMJN9.nsf/vwPagesWebLive/DOBJBG7K?opendocument [last accessed: 30 September 2022]