Fact Check

The MP in his statement claims that (1) CBSL maintains both the Employee Provident Fund (EPF) of private and semi-government sector workers and a separate provident fund for its employees; and (2) the CBSL Provident Fund (CBSLPF) gets a return of 29%, while the EPF gets a much lower return of 9%.

To evaluate these claims, FactCheck.lk consulted the CBSL Annual Report (CBSLAR) 2022, the 2022 financial statements of the EPF and the EPF Act of 1958.

Section 5 of the EPF Act designates the CBSL as the authoritative ‘custodian’ of the EPF. CBSLAR (Volume II, Part II, Page 35-40) confirms that the CBSL operates seven defined benefit plans, which cover all eligible CBSL employees, that can be collectively referred to as the CBSLPF. Thus, the MP is correct in claiming that both provident funds are managed by the CBSL.

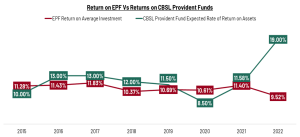

Exhibits 1 and 2 present the expected return on average investment of the EPF at 9.52% and the return on assets/investments of the CBSLPF at 19% for 2022 (see Additional notes 2 and 3). These figures, the CBSLPF figure in particular, do not align with those cited by the MP (9% and 29%).

The MP’s statement, however, can be read as referring to the return that is credited to the members of the funds (‘credited returns’), which can differ from the ‘investment return.’ Credited returns are calculated after deducting various expenditures, such as taxation. FactCheck.lk cannot verify the MP’s figures on the ‘credited returns’ (9% and 29%) for 2022 due to the lack of published reports since 2020. However, in a recent CBSL Monetary Board Review, CBSL Governor Nandalal Weerasinghe mentioned a special ‘formula’ used for the CBSLPF, which could make ‘credited returns’ much higher than ‘investment returns’ (for further details, refer to Additional 1).

The MP is correct in claiming that the CBSL manages a separate provident fund for its own employees in addition to managing the EPF and reports the credited return to the EPF member balances that are close to the investment return. The MP’s figures for the credited returns to the CBSL member balances exceed the expected return on investment, which is possible, but not verifiable from available data. Nevertheless, the MP is correct in his overall claim that the funds managed by the CBSL for CBSLPF are reported as having a much higher return in 2022 than the funds managed by the CBSL for the EPF.

Therefore, we classify the MP’s statement as TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

Additional Note 1:

At the Monetary Board Review on July 6, 2023, CBSL Governor Nandalal Weerasinghe is asked by a journalist why the CBSLPF received a 29% return while the EPF received only 9% in 2022. In response, the governor explains that there is a special “formula” used to determine returns to the CBSLPF. Although the published accounts reveal the growth of the fund to be 19% for the year 2022, the governor’s explanation suggests a different method of determining credited returns and tacit acceptance that it was 29% as stated by the journalist. The CBSL governor also explained that the ‘formula’ used to credit returns to the PF, increases the returns under abnormal conditions (e.g., when interest rates are very high). Having acknowledged the difference in returns between the provident funds, the governor indicated that the Monetary Board plans to review the ‘formulas’ used to compute returns.

Additional Note 2:

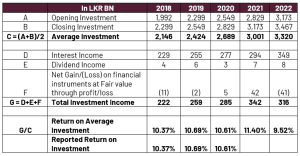

FactCheck.lk computed the 2022 EPF return on investment as the annual report was not published at the time of writing this fact-check. The return on investment is generally calculated as the total return on all investments divided by the average stock of investment for the year. Applying this same methodology for historical years (2018, 2019 and 2020) provides the same level of reported return on average investment. (Please refer to exhibit 1 for the breakdown of EPF return on average investment)

Additional Note 3:

Funds do not, typically, invest in physical assets, focusing instead on financial securities as their primary asset class. As part of the CBSL balance sheet, the CBSLPF can be compared to those of other CBSL assets, thus referred to as ‘Return on Assets”. This comparison allows for an assessment of the fund’s performance in relation to the overall financial performance of the Central Bank provident fund and can be understood to be equivalent to the term ‘return on investment’.

Exhibit 1: Computation of EPF return on average investment

Exhibit 2: Return on EPF vs Returns on CBSL Provident Funds

Sources

Accounts and Operations, Central Bank of Sri Lanka 2022, Available at: https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/publications/annual_report/2022/en/18_Part_02.pdf

Why is the interest rate higher for the provident fund of CBSL employees? මහ බැංකු සේවකයින්ගේ අර්ථසාධක අරමුදලේ පොලිය වැඩි ඇයි?, Central Bank of Sri Lanka YouTube page, Available at: https://www.youtube.com/watch?v=g248hjW-ELs

Financial Statements, Employees’ Provident Fund, Available at: https://epf.lk/?page_id=2738

Employees’ Provident Fund Act 1998, Available at: https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/laws/acts/en/epf_act.pdf