Fact Check

The statement in question was part of a longer parliamentary speech discussing the Betting and Gaming Levy (Amendment) Act, No. 11 of 2023 (BGL23). State Minister Siyambalapitiya argued that policymakers had made amendments to the taxation of casinos with the aim of increasing revenue collection and decreasing local participation. In this part of the statement, he claims: (1) a USD 50 entrance levy has been imposed on Sri Lankans, and (2) this levy along with its future increase to USD 200 has begun the process of reducing the participation of Sri Lankans in casinos.

To evaluate these claims, FactCheck.lk referred to BGL23, the previous Betting and Gaming Levy Act No. 14 of 2015 (BGL15), and data obtained through a Right to Information (RTI) request made by Verité Research (VR).

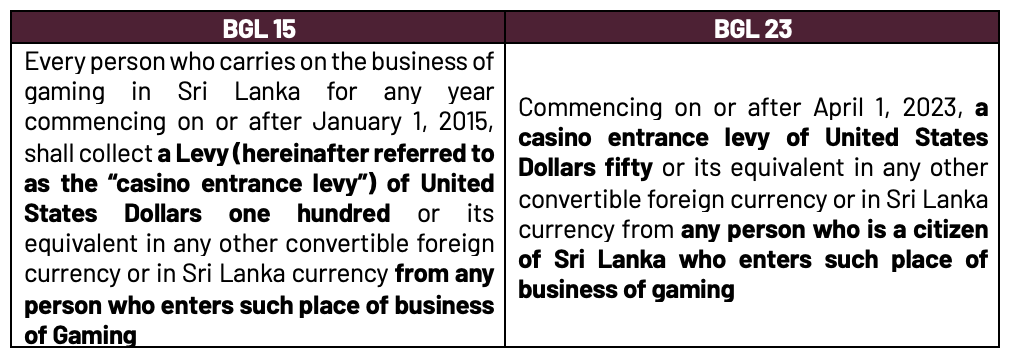

Claim 1: Exhibit 1 confirms that the recent amendment (BGL23) mandates a ‘casino entrance levy’ (CEL) of USD 50 to be collected from Sri Lankans.

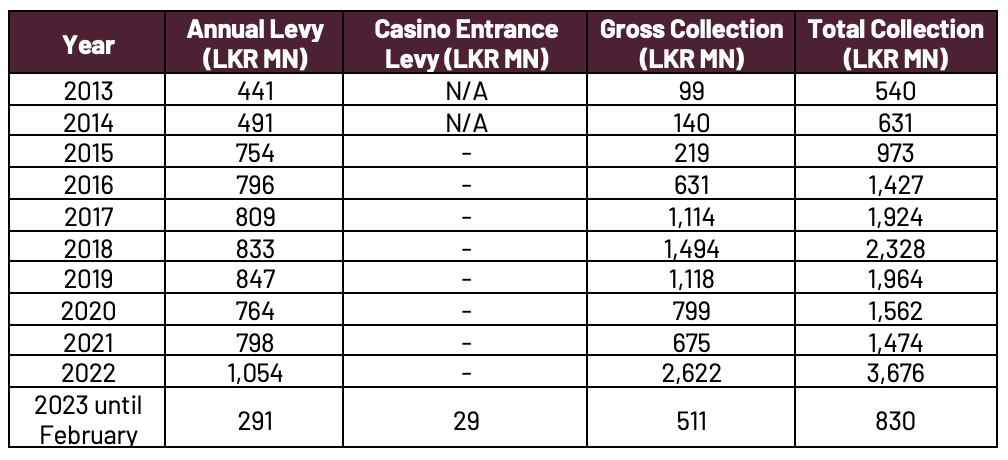

Claim 2: Data from VR’s RTI request confirms that the USD 100 CEL specified in BGL15 had not been collected until February of this year (See Exhibit 2) but was collected after.

Prior to the enactment of BGL23, the CEL of USD 100 was collected from both foreigners and Sri Lankans. Post enactment, the collection from Sri Lankans was reduced to USD 50 and the collection from foreigners was eliminated, effectively reducing it from USD 100 to zero (with retrospective effect from 1 April 2023).

The state minister is factually correct on the tax imposed on Sri Lankans by BGL23 and on the fact that the collection of CEL was begun only this year. However, he seems to draw the wrong conclusion in presenting BGL23 as reducing local participation and improving tax collection. He makes this mistake by failing to recognise that BGL23 has currently (a) encouraged local participation by reducing the CEL for locals by half, and (b) drastically reduced the tax collection from the CEL by eliminating the levy for foreigners.

Therefore, we classify the state minister’s claim as PARTLY TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

Exhibit 1: Changes made to Casino Entrance Levy

Exhibit 2: Response to a RTI request filed by VR to the IRD on the collection of the BGL

Sources

Betting and Gaming Levy (Amendment) Act, No. 14 of 2015, http://www.ird.gov.lk/en/publications/Acts_Betting%20and%20Gaming%20Levy/BNG_Act_No._14_2015_E.pdf

Betting and Gaming Levy (Amendment) Act, No. 11 of 2023, http://www.ird.gov.lk/en/publications/Acts_Betting%20and%20Gaming%20Levy/BNG_Act_No._11_2023_E.pdf

Notice: Implementation of Casino Entrance Levy, Inland Revenue Department: http://www.ird.gov.lk/en/Lists/Latest%20News%20%20Notices/Attachments/495/PN_CEL_2023_01_07022023_E.pdf