Fact Check

The information presented by the president is most easily interpreted as Sri Lanka pursuing a USD 17 billion reduction on the total stock of debt. However, it does not preclude another interpretation: a reduction in the flow of debt related repayments due from 2023-2027.

To check the claim, FactCheck.lk consulted the IMF Country Report on Sri Lanka (IMFCR) (No.23/116) and the investor presentation by the Ministry of Finance (MoF) in March 2023.

IMFCR states that “debt service reduction during 2023-27 should be sufficient to close external financing gaps. Under the staff baseline scenario, USD 17 billion in [external] debt service reduction is required”. The president’s claim uses this same language.

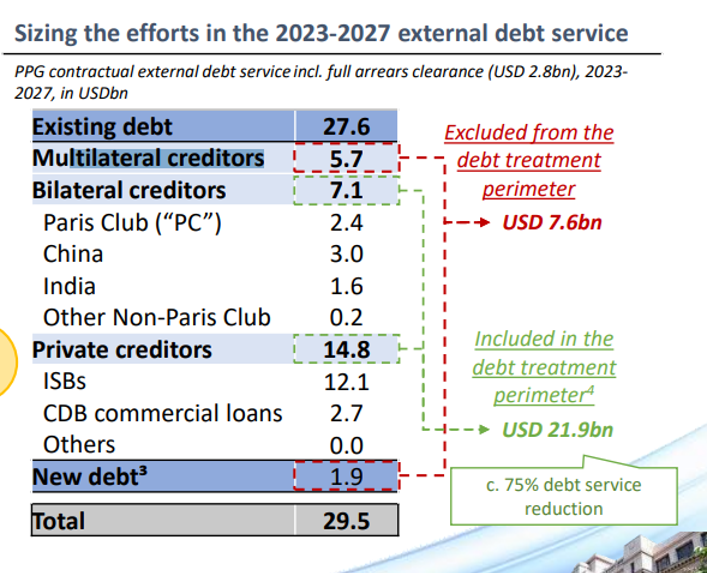

The MoF investor presentation in March 2023 shows this as a USD 17 billion reduction in the flow of re-payments between 2023-2027, not the stock of debt (see Exhibit 1). The flow of repayments on new loans taken, and to multilateral creditors, are not expected to be reduced. Instead, the USD 17 billion reduction is through an expected reduction of 75% in the flow of repayments currently due between 2023-2027 to existing bilateral and private creditors.

The president challenges parliament: “So, we are trying to get a 17 billion debt reduction on that side. Do you want it or not” – allowing the interpretation that the reduction will be in the debt stock. However, the description of the reduction that he provides uses the language of the IMFCR, where the reference is to the flow of repayments.

Therefore, we resolve the ambiguity and classify his statement as TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

Exhibit 1: External Debt Service payments in 2023-27 (Extracted from the Ministry of Finance Investor Presentation)

Source: Ministry of Finance Investor Presentation in March 2023

Additional Note

The difference between reducing the flow and stock of debt might be understood with an example: in Sri Lanka, the moratoriums provided by banks during the Covid-19 pandemic, allowed postponement in the re-payment of loans. However, it didn’t reduce the capital or interest amounts due on those loans; if the interest payments were suspended, they were added as capital to the total debt stock due. Those who received the moratorium had their flow of debt repayments reduced during the period of the moratorium; but were required to pay the entire stock of capital plus accrued interest after the moratorium ended.

Sources

International Monetary Fund Country Report on Sri Lanka (No.23/116), available at https://www.elibrary.imf.org/view/journals/002/2023/116/002.2023.issue-116-en.xml [last accessed 18 May 2023].

Central Bank of Sri Lanka Ministry of Finance, Economic Stabilization & National Policies Investor Presentation, March 2023, available at https://www.treasury.gov.lk/api/file/9f8870d3-4840-443d-b552-e5c0890e1613 [last accessed 18 May 2023].