Fact Check

FactCheck.lk interpreted “loans taken” as referring to net additions to the loan book of the government. The net addition is calculated as loans taken minus the capital repayment on existing loans.

Therefore, we interpret the “settling loans” to refer to settling the interest payment on the previous loans. As such, the UNP deputy leader’s claim is that as much as 80% of the addition to the loan-book of the government during the yahapalana government’s tenure (2015 – 2019) was to settle the interest payments on the previously accumulated loans.

To check this claim, FactCheck.lk consulted the Demystifying increase in Sri Lanka’s debt insight published by Verité Research.

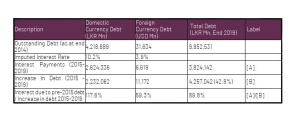

Exhibit 1 extracted from the insight shows that 89.8% of the increase in the total debt stock from 2015 – 2019 was due to servicing interest on accumulated debt as at end of 2014.

In claiming (as we have interpreted him) that most of the addition to the loan book was to settle the cost of past loans (interest payments), the UNP deputy leader cites the proportion to be as much as 80%. The published analysis shows that this proportion and even more (89.8%) was used to service the interest on past loans.

Therefore, we classify his statement as TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

Exhibit 1: Impact of past interest payments on the debt increase between 2015-2019

Source: the Demystifying increase in Sri Lanka’s debt insight by Verité Research.

Sources

Demystifying increase in Sri Lanka’s debt by Verité Research available at; https://www.dailymirror.lk/other/Demystifying-increase-in-Sri-Lankas-debt/117-226501 [Last accessed 19th May 2022.