Fact Check

During the committee stage debate of the 2024 Budget, State Minister of Finance Shehan Semasinghe claimed that: (a) “[lower] remittances from foreign workers”, and (b) “[lower] income from tourism” were two “main factors” that contributed to the “foreign exchange crisis” of 2022 in Sri Lanka.

To verify this claim, FactCheck.lk consulted the Ministry of Finance (MoF) and Central Bank of Sri Lanka Annual (CBSL) Reports from 2017 to 2022.

FactCheck.lk interpreted the state minister’s claim as referring to the foreign currency liquidity crisis, which arises when a country does not have enough foreign currency (by way of foreign currency inflows or excess foreign currency reserves) to cover its foreign currency outflows.

The main sources of foreign currency inflows for Sri Lanka include inflows of foreign debt (loans), proceeds from exports, foreign remittances, and earnings from tourism. The main sources of foreign currency outflows include repayments of foreign debt, and expenditures on imports.

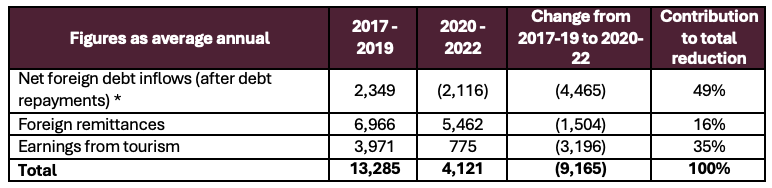

To evaluate the state minister’s claim, FactCheck.lk compared changes in foreign currency inflows and outflows during the foreign currency crisis (2020-2022 – the years of Covid-19 and economic crisis) and for the same number of years prior to that (2017-2019). Exhibit 1 highlights these changes to foreign currency flows that led to the foreign currency liquidity crisis. The trade balance is not included as a driver of the crisis because it improved rather than declined (trade deficit reduced) during the crisis period.

Exhibit 1 shows that the single largest driver of the foreign currency liquidity crisis is the reduction in net foreign debt inflows (inflows of foreign loans minus outflows of re-payments, including those that were due to be paid but defaulted on due to the crisis in 2022). When considering the total impact from reduction in tourism, remittances, and net foreign debt inflows, the latter contributed the most, making up 49% of the total foreign currency liquidity reduction.

The MP is correct on the impact of reduced remittances and tourism income, each being significant contributors to the 2022 foreign currency liquidity crisis (contributing to 16% and 35% of the reduction in the period). However, the MP misdiagnoses the reasons for the crisis by omitting the single most significant cause of the foreign currency liquidity crisis: the reduction in the net foreign debt inflows—which accounted for half (49%) of the foreign currency reduction among these three factors.

Therefore, we classify the state minister’s statement as PARTLY TRUE.

Exhibit 1: Changes to foreign currency flows between 2017-19 and 2020-22 (in USD MN)

*Note: Debt repayment includes capital and interest on foreign currency debt repayments. The 2022 total foreign debt repayments include scheduled payments that were then not settled due to the suspension of foreign debt service in April 2022.

Additional note 1 – The reduction in remittances to Sri Lanka during 2020-2022 can be linked to government policies, particularly the artificial maintenance of the exchange rate close to LKR 200 per USD during the latter part of 2021. This policy led to the emergence of a “grey market” for currency exchange, offering rates at least 20% higher than the official market rate offered by official banking channels. This discouraged foreign remittances into Sri Lanka as well as diverted them away from official channels. Information on this is available in the following article by the Institute of Policy Studies of Sri Lanka.

Sources

Weekly Economic Indicators, Central Bank of Sri Lanka, April 2022. https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/statistics/wei/WEI_20220401_e.pdf

Annual Reports (2017 – 2022), Ministry of Finance, https://www.treasury.gov.lk/web/annual-reports

Annual Reports (2017 – 2022), Central Bank of Sri Lanka, https://www.cbsl.gov.lk/en/publications/economic-and-financial-reports/annual-reports