Fact Check

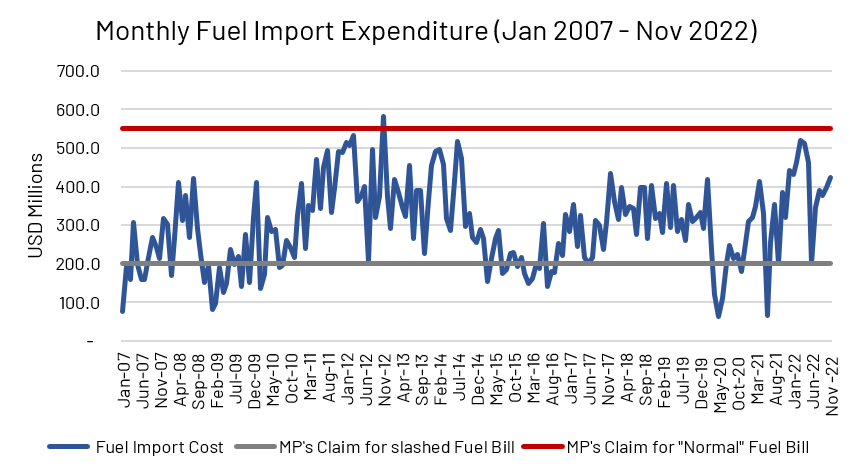

In an exclusive interview with the Daily Mirror, the MP cites the reduction in the monthly fuel bill as an example of why Sri Lanka’s current economic “normalcy” is on an “uneasy equilibrium”. In his example, he says that the country is saving around USD 350 million a month by cutting down the fuel bill from around USD 550 million to USD 200 million a month – suggesting that the equilibrium the MP deems unsustainable is that of the balance of inflow and outflow of foreign currency.

To evaluate the above claim, FactCheck.lk consulted the weekly economic indicators, monthly import expenditure and sales of petroleum products published by the Central Bank of Sri Lanka (CBSL).

On the USD 550 million, Sri Lanka’s monthly import data reports show that it has only once spent over that amount on fuel. This was in November 2012, when the monthly fuel bill is reported as USD 581 million.

On the USD 200 million, the reported monthly fuel bill has been close to this only in one out of the last 12 months, with the last 6-month average being USD 355 million and the last 3-month average being USD 398 million (see Exhibit 1).

To check the MP’s claim of savings made on a “normal fuel bill”, the monthly average fuel import expenditure was compared between 2019 (pre-Covid 19, and prior to the current economic crisis period), and 2022 (up to November). The data shows the value of the monthly average fuel imports as having risen by USD 86 million between these periods. Therefore, the figures cited by the MP, in his example of the savings made on foreign currency outflows for fuel, are contrary in every respect to what is seen in the official data.

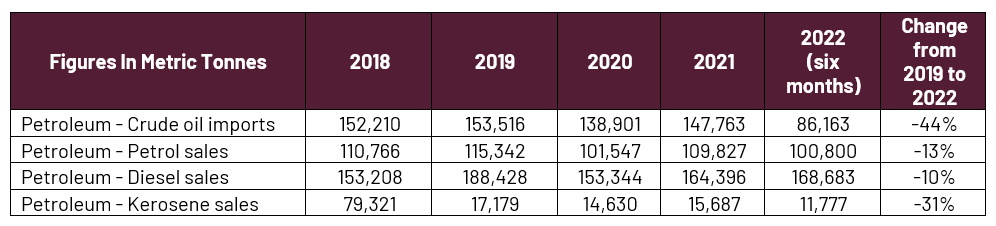

To check the MP’s broader claim on the “uneasy equilibrium” of net currency inflows/outflows as connected to fuel imports, FactCheck.lk also consulted CBSL data on the quantity of petroleum products imported and sold. Contrasting the 2019 and 2022 import and sales quantities show that sales of petroleum products in 2019 and 2022 have fallen by 31%, 13%, and 10% for kerosene, petrol, and diesel respectively; and a reduction of crude oil by 44% (see Exhibit 2). This suggests, that despite the import values not reducing as claimed, the currency inflow/outflow equilibrium is dependent on the unusual and enforced contraction in demand in the petroleum sector (with fuel quotas and power cuts).

Overall, the MP is quite incorrect in the supporting numbers and example he provides. But he could have supported his larger point of an uneasy equilibrium in the balance of foreign currency inflows/outflows, had he referred to the quantity of imports/sales rather than the cost of the same. Therefore, we classify his statement as PARTLY TRUE.

*FactCheck.lk’s verdict is based on the most recent information that is publicly accessible. As with every fact check, if new information becomes available, FactCheck.lk will revisit the assessment.

Exhibit 1: Monthly Fuel Import Bill

Source: Monthly Import Expenditure Reported by the Central Bank of Sri Lanka (CBSL)

Exhibit 2: Monthly Average Petroleum Related Product Sales and Crude Oil Imports

Source: Central Bank of Sri Lanka

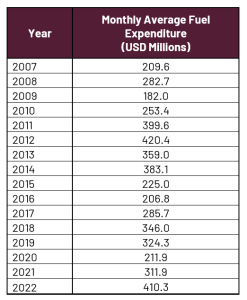

Exhibit 3: Monthly Average Fuel Import Bill

Source: Monthly Import Expenditure and Weekly Economic Indicators reported by the CBSL

Additional Note

The latest available data (from 2007 till November 2022) shows that the monthly average on the fuel bill has been less than USD 550 million every year. The monthly average has been less than USD 200 million only in 2009 (see Exhibit 3).

Sources

Monthly Import Expenditure Reported by the Central Bank of Sri Lanka (CBSL), Available at; https://www.cbsl.gov.lk/en/statistics/statistical-tables/external-sector [Last accessed 01 January 2023]

Source: Central Bank of Sri Lanka Data Library, Available at; https://www.cbsl.gov.lk/en/statistics/data/economic-data-library [Last accessed 01 January 2023]

Monthly Import Expenditure and Weekly Economic Indicators reported by the CBSL, Available at; https://www.cbsl.gov.lk/en/statistics/economic-indicators [Last accessed 01 January 2023]